Trends of the Public Debt in Kenya

Trends of the Public Debt in Kenya

| Post date: Fri, Sep 14, 2018 | | Category: Debt | |

The institute of Economic Affairs-Kenya is undertaking a study on the public debt in Kenya. The study entails analyzing and tracking of Kenya’s current debt levels including an analysis of revenue, taxation and public expenditure trends. In order to enhance understating of the facts concerning Kenya’s debt a series of short blogs will be generated for each week running for a year. This is the first of the 45 series of blogs that will be generated. It looks at the current trend of both the domestic and external debt stock in order to provide the current state of affairs and the general direction debt accumulation.

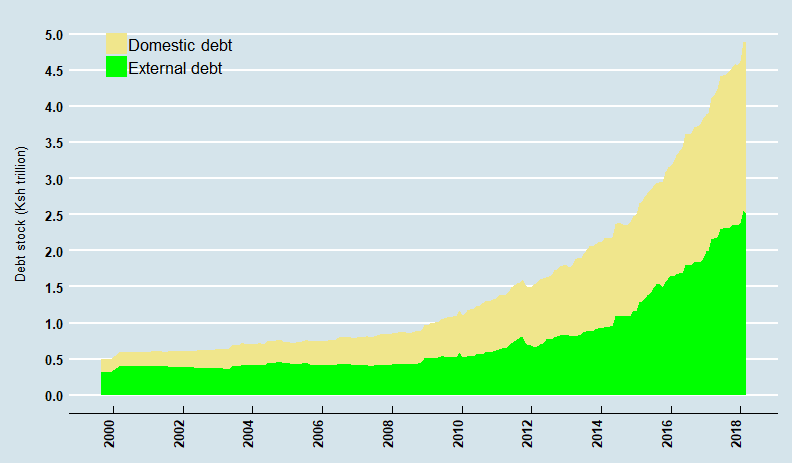

Source: Central bank of Kenya

As at March 2018, the total stock of debt in Kenya amounted to Ksh 4.9 trillion, comprising Ksh 2.37 trillion domestic and Ksh 2.51 trillion external debt.

Number of the Week: 106,000

- The current public debt stock (Ksh 4.9 trillion) translates to Ksh 106,000 per Kenyan and

- At the end of 2017, the total debt stock amounted to Ksh 4.57 trillion, compared to Kenya’s GDP of Ksh 7.7 trillion, translating the share of debt to be 59.3% of GDP.

- By the end of February 2013, the total debt stock was Ksh 1.78 trillion which implies that in the last five years, the total debt has increased by a factor of 2.8, that is, almost three times compared to when Jubilee Administration took over power.

Though borrowing in itself is not a bad policy option from the reasoning that it helps in stabilizing the economy. Choosing to borrow over high domestic taxes helps the economy improves by releasing the individuals and firms from tax burden. As a consequence, there is high propensity for individuals and firms to engage in economic activities increases, an effect known as crowding in. The government can also acquire infrastructure in the short term so that it can be utilized by economic agents as it spreads its payment in the future.

However, implications of the steady rise in the stock include increase in debt servicing obligations which consequently shrinks the budget for other development activities. As the debt stock rises, so does the interest payments which may pose a challenge on the country’s cashflow. Government may resort to increase in domestic taxes to service the debt, this may further affect the economy through crowding out the private investment which leads to reduced economic progress.

The recent trend in heavy bilateral borrowing for instance from China and the Eurobond may further increase the debt default risk.

As a way forward there need to have austerity measures by reducing the deficit financing and focusing on efficient utilization of public funds. This includes improved management of mega projects such as Standard Guage Railway (SGR) to enhance profitability in order to contribute significantly in servicing the loans. The government and all the stakeholders need to increase the effort in curbing corruption by enhancing transparency of the procurement and other financial records and accountability. There is also need to reduce on deficit financing in order to minimize dependence on borrowing. Greater focus should also be directed towards sealing the loopholes in revenue wastages through enhanced automation of taxes

More Number of the Week

Kenya’s comparison of Out of pocket expenditure on Health with its peers

In the advent of increased Non-Communicable Diseases such as cancer that require long time treatment, reduction of the Out-of-pocket payments is key in sustaining affordability and access to health care services. These can be achieved through increased insurance both by the government and the private sector.

Outstanding Stock of Treasury Bonds by Holders

Treasury bonds are a secure, medium- to long-term investment tools that typically offer periodic interest payments semiannually throughout the bond’s life. The Central Bank auctions Treasury bonds on a monthly basis, but offers a variety of bonds throughout the year, so prospective investors should regularly check for upcoming auctions. Outstanding Treasury Bonds increased by 11.2 per cent to Ksh 1,152,041 million in June 2016 from Ksh 1,035,662 million in June 2015.

Outstanding Stock of Treasury Bills by Holders

In June 2016 compared to June 2015, the stock of Treasury bills increased by 84.4 per cent to Ksh 588,088 million from Ksh 318,929 million while the proportion held by commercial banks increased by 67.4 per cent to Ksh 361,859 million from Ksh 217,742 million. In the same period, holdings by pension fund institutions increased to 20.1 per cent from 12.8 per cent while proportion held by insurance companies decreased to 3.1 per cent from 6.5 per cent.

Outstanding Stock of Treasury Bills and Bonds by Holders

The medium term debt strategy for the financial year 2016/17 emphasized on the need to develop the domestic market by increasing the issuance of Treasury bonds over the medium term. The strategy targeted a mix of 60 percent and 40 per cent for external and domestic financing, respectively.

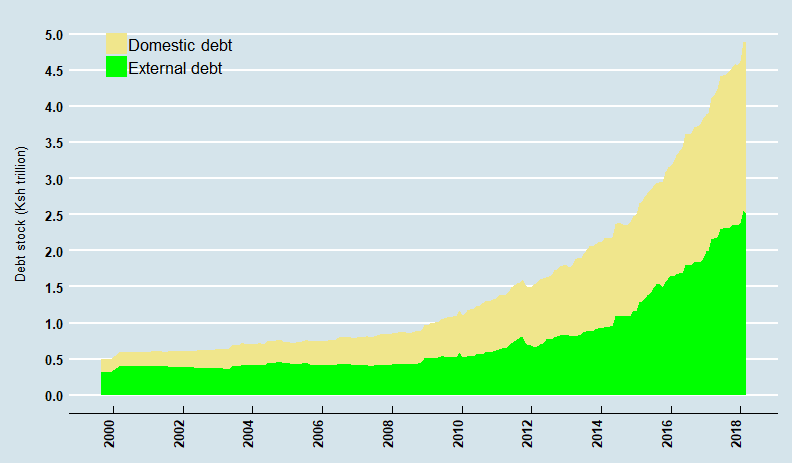

Trends in Kenya’s Total Domestic Public Debt Stock from 1999 – 2018 (In nominal terms)

Trends in Kenya’s Total Domestic Public Debt Stock from 1999 – 2018 (In nominal terms) Source: Central Bank of Kenya The number of the Week: 2.1, this is the factor by which domestic debt has grown in the last five years. Domestic debt has nearly doubled in the last five years (2013-2018) Between 1999 and […]