The Viability of Turkana Oil

| Post date: Fri, Oct 16, 2020 |

| Category: General |

| By: Emmanuel Wa-Kyendo, |

In 2012, Kenya’s oil discoveries were greeted with nationalist fervor. Pundits, officials, and their surrogates played avatar to the proposition that Kenya’s economic wants would soon be fulfilled by an oil bonanza. Some were inspired to prepare for a migration of labor and capital into oil production. Others erred towards caution. Others still expressed the nationalist wish that Kenya’s oil find would exceed that of neighboring Uganda. Kenya would soon be like Dubai, an oil wealth exemplar, and favorite vacation haunt of the well-heeled. Were their well-intentioned hopes misplaced?

In the face of global economic strife, the state of Kenya’s foreign exchange reserves is not too good. Depressed oil prices bode ill for marginal oil producers. The nation’s public budget is also not quite under control. Foreign exchange reserves are important for the contribution they make towards meeting a country’s foreign currency obligations. These are generated through export sales made in foreign currency and foreign currency injections in the form of investments and or remittances. Kenyan oil was to contribute to foreign currency earned through exports. More broadly, economic activity is an important determinant of both public revenues and foreign exchange reserves. Many hoped that Kenyan oil would have a positive multiplier effect on the economy. At times, those who spoke in hyperbole did not support their statements with statistics. I attempt to contribute to this discussion with a simple analysis by asking just how viable Kenyan oil is?

Part I: The Quality and Quantity Of Turkana Oil

How Is the Quality of oil Determined?

At present, Kenya’s oil extraction efforts are centered around oil wells located in Lokichar, Turkana county. We will refer to this oil as Turkana crude.

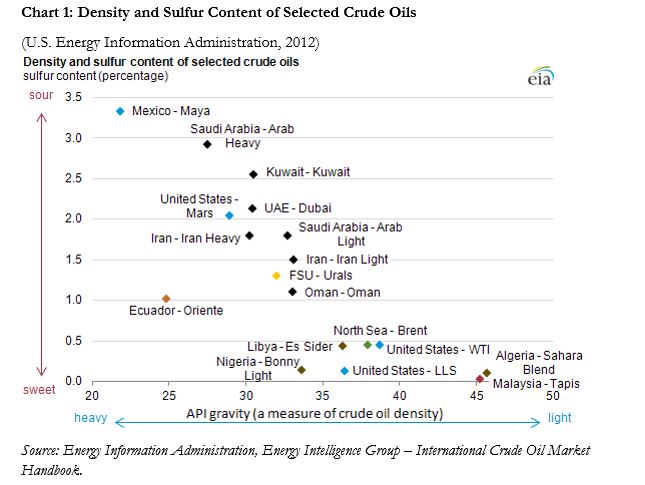

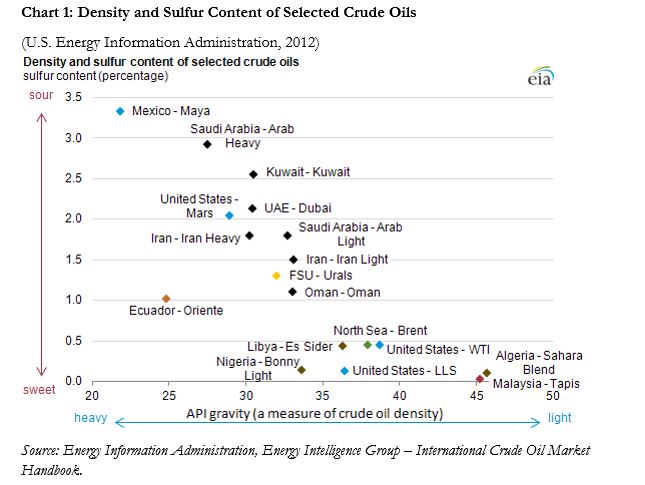

Generating profits is a matter of optimizing price and cost. Alongside the oil quantum, the quality of oil is an important determinant of production cost. Among many other qualities, oil is graded by density and Sulphur content. Chart 1 above is a matrix of oil density and Sulphur content. Density is graded in ‘light’ and ‘heavy’ terms whereas Sulphur content is graded in ‘sweet’ and ‘sour’ terms. In general, a high volume of impurities and a high weight make it more difficult to extract oil. Difficulty in extraction raises extraction costs. Chart 1 above shows that Algerian and Malaysian oil are the sweetest and lightest in the world.

Experts hold that Kenya’s Lokichar crude is light and sweet with an API of 32-38 and sulfuric content below 0.5%. The quality of Kenya’s Lokichar crude is at parity with UK Brent oil. Importantly, Kenya’s oil has a 40% waxy content . If not kept at temperatures above 40 degrees Celsius, the waxiness of this oil reduces its viscosity. This drives up transportation costs as pipelines and trucks must be specially equipped to keep the oil at a desirable temperature. The relative impurity of Kenyan oil can be inferred.

Interestingly, the same experts reveal that the first batch of Kenyan oil exports were sold at a discount of US$2 per barrel relative to the UK Brent Blend.

Kenya is unlikely to be an Oil Market Maker

A barrel is a standard unit used by the oil industry. A barrel holds 159 liters of crude oil.

Economically viable oil reserves are classified as proven. The 2020 British Petroleum (BP) Statistical Review of World Energy estimates placed the worlds proved reserves at 1733.9 billion barrels at end of 2019. By 2019, Venezuela had the largest reserves in the world. Libyan oil reserves were the largest on the African continent.

By end of 2019, Africa had 125 billion barrels or 7.2% of the world’s quantum of proved reserves. South Sudan had 3.5 billion barrels . Kenya’s 560 million barrels gave it a small 0.032% share of the world’s reserves .

For the purposes of scale, a typical office has a 20 liter water dispenser. Imagine a glass that can hold about 250ml of water, leaving room to prevent spills. If that 20 liter water dispenser represents the worlds proved reserves of oil, Kenyan oil would account for 6 milliliters or 2.5% of a 250 ml glass of water. In the global market for crude, Kenya cannot be a market maker.

Finally, were each of Kenya’s 47.6 million citizens to receive an equal share of the Turkana oil, none would receive more than 10 barrels in a lifetime. The quantum of Kenya’s oil reserves is presently inconsequential.

How does Kenya’s Oil Quantum Compare with South Sudan?

Comparing Kenya’s and South Sudan’s oil quantum’s is instructive. Having gained independence in 2011, Kenya’s neighbor South Sudan is the youngest country in the world. South Sudans’ oil was an important feature of the internal conflict that saw the greater Sudan split in two. Accounting for 95.3% of the country’s exports, South Sudan is heavily dependent on oil. South Sudan is also one of the region’s most important oil producers.

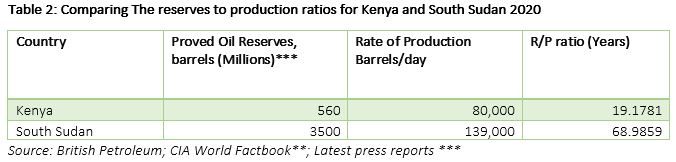

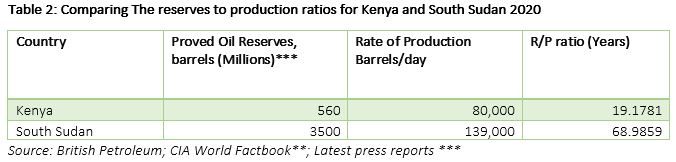

Table 2 illustrates Kenya’s and South Sudan’s proved oil reserves and their life span based on the most recent production rates. Proved reserves can also be classified according to the length of time in years during which they oil can be pumped at the present extraction rate. This classification is termed the reserves to production ratio (R/P). For example, if they are pumped at their 2019 production rate of 17.5 million barrels a day, The United States of America’s proved oil reserves have an R/P ratio of 11.1 years. On the other hand, if the republic of Iran maintains an extraction rate of 3.5 million barrels a day, it will enjoy 120.6 more years of oil production.

Based on extraction rates of 80,000 and 139,000 barrels per day, Kenya and South Sudan have 19.18 and 68.99 more years respectively . To date, Kenya’s extraction rate has hovered at 2,000 barrels/day . Tullow oil, the producer of Kenya’s Turkana Crude, projected that its production would reach 80,000 barrels a day but has not attained the goal . We estimate Kenya’s R/P at this 80,000 barrels a day production rate, none the less. Importantly, the actual extraction is a telltale of viability. South Sudan has been extracting and selling its oil. Kenya’s has been stored in Mombasa. By inference, the market demand for South Sudanese oil seems to imply that their oil is more economically viable than that of Kenya.

Part II: Simulating The Production Cost and Revenues Of Kenyan Oil

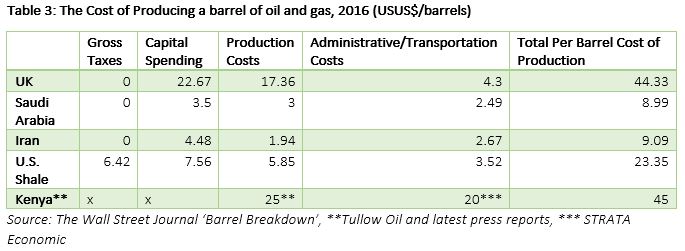

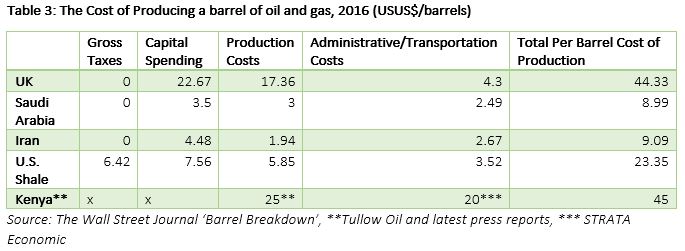

In 2016, the wall street journal provided a breakdown of the production costs of a collection of crude oil products sold in the international market. It is important to note that this breakdown of the cost structure does not include a break even assessment. Each country and or company will have a break-even point determined by other costs that are not reflected by this submission by the wall street journal. Nevertheless, it is an instructive illustration about the global differences in the economic obstacles to oil extraction.

Table 3 illustrates the cost of producing a barrel of oil and gas in 2016. In 2016, the Wall Street Journal estimated that British Brent Crudes’ US$44.33 made it the most expensive of the highest volume crude oil products. Iranian and Saudi Arabian oil were among the cheapest to extract. This Their quantum and ease of extraction make Saudi and Iranian oil extremely efficient to extract. Though these estimates are dated, Saudi and Iranian oil remain among the cheapest to produce. The relative differences in oil production costs is still instructive.

Oil extraction sites are usually separate from the point of processing or export. Transportation costs feature prominently in production costs, therefore. Research firm Strata economic estimates that it in the United States it costs US$5, US$20, US$15 per barrel to transport a barrel of oil by pipeline, road and rail respectively . Kenya’s oil has been transported by road. In our model, we assume that the lower break even cost cited does not include transportation costs. The Kenyan press has indicated that Turkana crude cannot break even at prices below US$25 . Other sources have cited prices of US$50 to US$55 . Rystad, a Norwegian energy research firm estimates that in 2020, Turkana oil fields will need break even prices of US$60.65 per barrel . This seems to imply a degree of secrecy as to the actual costs of production. Putting all this together, we estimate for a US$45 per barrel cost for Kenya’s Turkana oil. Notably, this cost is still lower than the upper bound break-even price cited by some sources.

In principle, market prices that sit above production costs incentivize producers to increase supply. Supply decreases with decreases in market price. Furthermore, a producers break-even point bears a considerable bearing on the output level decision. Saudi Arabian crude oil are an important facilitator of the Saudi social contract. Analyst Andrew Hecht estimates that despite low production costs, the central role of petrodollars has driven break even costs of Saudi oil to US$80 dollars.

The true breakeven cost of Turkana crude oil remains unavailable as of this writing. In August 2019, Kenya sold its first export of 200,000 barrels of this oil at a price of US$60 per barrel. Turkana oil is extracted almost 800 kilometers away from the port of Mombasa – the closest port. Oil tankers impose minimum loading requirements for crude oil. A long distance from port and low production rates combined forced the producer to stock the 200,000 barrels over a matter of months before they met tanker requirements. Turkana crude oil becomes solid at temperatures below 40 degrees Celsius. Whatever the actual production costs may be, Turkana crudes’ waxy content imposes a requirement that oil transportation methods – whether by road or pipeline – include costly heating mechanisms. It seems that no matter how one looks at it, Turkana crude does not rank among the cheapest to produce.

Turkana Crude Revenue Simulation

Having illustrated the difficulty in producing Kenyan oil, a breakdown of production costs would allow us to arrive at an estimate of the economic viability of this oil. We approach this calculation in two ways. The first approach simulates the net revenues of Turkana crude at recent oil prices. The second approach simulates the revenues that can be generated at different profit margins.

How Might Turkana Crude Compare with UK Brent Crude and Saudi Crude?

The table above illustrates the oil prices of a collection of products of 5th October, 2020. The data is provided by ‘Oil Price’, a firm providing up to date oil market data . We use the data to build a simulation of the revenues that can be generated from Kenya’s Turkana Crude.

We use the production cost structures supplied by the Wall Street Journal in 2016 to simulate the revenues generated by UK Brent, Saudi and Turkana crude oil. For lack of better estimates, we assume that it is authoritative. UK Brent is chosen for the reason that Turkana crude oil is most similar to it. The first export of Turkana crude was marked against the price of UK Brent . Saudi Arabia is chosen to emphasize the effect of a high quantum of reserves and low production costs on revenues. At the time of this writing, more up to date sources on oil production cost structures were not freely available. Finally, the operators of Kenya’s Turkana oil fields have expressed their desire to extract 80,000 barrels of crude oil per day . To date, they have only managed to extract 2,000 barrels per day.

Saudi oil is generally an efficient and highly profitable crude oil product. On the other hand, Turkana crude requires much higher oil prices to generate profits. The 2019 sale of 200,000 barrels at US$60 per barrel demonstrates as much . The sale generated a reported $14 million in revenues.

This simulation is a sufficient representation of reality because it is generally observed that large oil producers will continue to produce at a loss. Presumably, it is better to keep a large oil extraction operation running than to shut it down. Global oil price fluctuations pose strategic difficulties for small producers. Turkana oil well strategy is constricted by its small quantum, distance from the port of export, and minimum quantity requirements to secure room on an oil tanker. Thus far, the operator has countered this difficulty by stocking product, locking in a price from a specific consumer and then shipping when the stock is full . The strategy has been employed on a single sale alone . Our analysis demonstrates the sensitivity of this small producer to price fluctuations. When compared to a smaller cutter, a large cruise ship needs more runway to take off and land and clearer waters to maneuver.

Honeymoon Analysis

Crude oil sales can generate foreign reserves, tax revenues and cash windfalls. Combined, these sums can contribute to Kenya’s efforts to industrialize and develop. The excitement about crude oil bounties may have been genuine if unrealistic. In our simulation, we suppose that the future portends something of an everlasting honeymoon. In our honeymoon analysis, we assume that Turkana crude oil sells at a profit margin of USUS$10 per barrel for 25 years, the estimated lifespan of Turkana oil wells . If the USUS$10 per barrel margin was a share of the US$60 per barrel price on which the first batch of Turkana Crude oil was sold, it would represent a 16.67% profit. This is a large margin compared to the average profits earned by big oil that amount to just about 6.7%. Our simulated profit margin would represent quite the honeymoon.

The World Bank estimates that Kenya’s GDP was US$78 billion in 2017 . The Observatory Economic Complexity estimated the value of Kenyan exports at US$6.17 billion in 2017 . Under our honeymoon conditions a daily production rate of 2,000 barrels per day would generate annual revenues that would make up a 2% share of annual exports. Revenues generated over a 25-year period still do not compare favorably relative to the value of one years’ worth of exports let alone GDP.

Kenya’s is an agrarian economy. Tea is Kenya’s most valuable export. Kenyan exports in tea alone were valued at an approximate US$1.33 billion in 2017. This is greater than the annual revenues that Turkana crude oil would generate under our simulated conditions.

Whichever way one looks at it, Kenya’s oil does not represent a sea change in the country’s fortunes.

How Might Different Profit Margins Affect Turkana Crude Revenues?

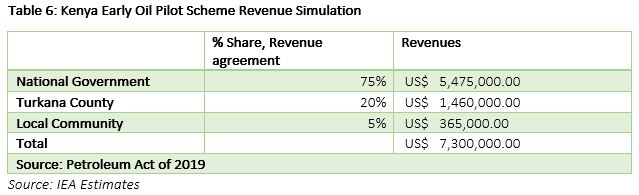

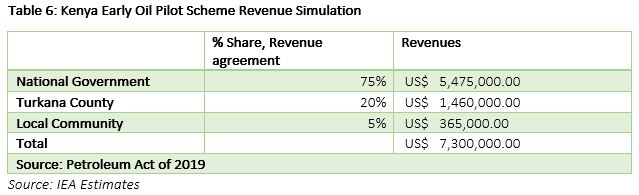

Table 6 above illustrates a simulation of the Kenya Early Oil Pilot Scheme. As the name suggests, the Kenya Early Oil Pilot Scheme or EOPS is an effort to test the market for Kenya’s crude. Keen to see to it that the revenues benefit the community, the Kenyan government generated a revenue sharing formula. Presented above is the formula. This formula assumes that producer firms own revenues have been deducted.

We assume a US$10 margin on each barrel. US$10 per barrel margin assumption after producers royalties have been deducted is more than ample. We estimate that on a US$60 barrel, this is larger than the 6.7% margin that big oil commands .

The Kenya EOPs has been pumping 2,000 barrels a day. Assuming a US$10 margin on each barrel would generate total annual revenues of US$7,300,000. The national government would earn 75% of this share or US$5,475,000. Turkana county would earn US$1,460,000 annually. The local community would itself be entitled to US$365,000. The 2019 Kenya National Bureau of Statistics Population and Household survey revealed that Turkana’s 2019 population was 926,976 . Were each of these residents to receive an equal share of the revenue as presented above, they would earn US$0.39 or Kshs 40 annually.

In August 2019, the oil stock at Mombasa port was packed up and exported. This would mark Kenya’s first exports in petroleum. The quantum of that stock was 200,000 barrels . If Turkana Crude were fetching US$35 per barrel, revenues would be around US$7,000,000. Turkana residents would barely earn a dollar each from this sale.

Notably, Kenyan oil must be stored in Mombasa until it can be exported in batches of 200,000 barrels or more. This particular constraint is placed by tanker specifications. It is unprofitable to load a tanker with a lower quantum than this. For its first export batch, Tullow oil resolved this problem by prearranging a delivery contract with the buyer, ChemChina UK Ltd. Tullow oil is likely to maintain similar arrangements in the near future.

As far as the objective of maintaining a profitable operation is concerned, the entrepreneurs on the ground know their costs better than we do. All we can ascertain is that the revenues generated in 2019s US$14,000,000 sale future exports would barely raise the per capita earnings of each Turkana resident .

Conclusion

Turkana crude is small in quantity and of a quality that increases extraction challenges and costs. These two factors make for a crude oil that is markedly inefficient to produce.

Based on the quantity of proven reserves and the quality of the crude oil, it is highly unlikely that Kenya would become a market maker. It must take the prices that the markets set. In the region, the economic viability of South Sudan’s oil has been proven to a greater degree than that of Kenya. The markets have demonstrated as much.

Road transportation is an important component of the cost of Turkana crude oil production. It is not industry practice to transport crude oil for long distances by road. Pipelines are more cost effective. Unfortunately, Kenya’s plans to build a pipeline together with Uganda has fallen apart.

In the short run, Kenya will continue to export its oil by stocking it in the port, securing a single buyer and then exporting when the stock meets oil tanker requirements.

Our simulations have been made with assumptions that might be closer to ample than they are to plausible. In the best of cases, Kenya’s oil revenues are inconsequential relative to GDP and exports. When economic growth is taken into consideration, the insignificance of Turkana crude relative to the nation’s economy is made increasingly apparent.

All in all, if there ever is an oil driven Dubai in the Savannah, it will certainly not be built from the wealth generated by EOPs or any further developments of Turkana Crude.

Bibliography

- Akinosho, T. (2020, April 29). Kenya Makes $14 Million from ‘Trickles’ of Oil Export. Retrieved from Africa Oil Gas Report: http://africaoilgasreport.com

- British Petroleum. (2020). Statistical Review of World Energy, 2020. British Petroleum.

- Fawthorp, A. (2020, April 16). How will Africa be affected by the Oil Industry’s Capital Investment Cuts? Retrieved from NS Energy: http://www.nsenergybusiness.com

- Gupte, E. (2019, August 27). Kenya Exports First Crude Cargo, Boosting oil Ambitions. Retrieved from Standard and Poors Global: www.spglobal.com

- Hansen, M. E., & Dursteler, E. (2017). Economic, Environmental and Safety Impacts of Transporting Oil and Gas in the U.S. .

- Hansen, M. E., & Dursteler, E. (n.d.). Pipelines, Rail and Trucks. Strata Economic.

- Houreld, K. (2016, October 7). Kenya Oil Official Sees Break-Even Price at $50-55 per Barrel. Retrieved from Reuters: http://www.reuters.com

- Karambu, I. (2016, February 11). We can’t Break Even at Less than $25 a Barrel, says Tullow. Retrieved from Nation Media: http://www.nation.africa

- Kenya National Bureau of Statistics. (2019). 2019 Population and Housing Census . Kenya National Bureau of Statistics.

- Kenya National Bureau of Statistics. (2020). Kenya Economic Survey 2020. Kenya National Bureau of Statistics.

- Markey, D. (2020, October 5). Big Oil Industry’s Profit Percent Average. Retrieved from Smallbusinesschron: http://www.smallbusiness.chron.com

- Observatory Economic Complexity. (2020, October 5). Kenya.

- Oil Price. (2020, August 31). Oil Price Charts. Retrieved from Oil Price: https://oilprice.com/oil-price-charts/block/1

- Okoth, E. (2020, February 9). Tullow Job Cuts in Kenya Deepen Oil Export Doubts. Retrieved from The East African: http://www.theeastafrican.co.ke

- Owili, R., & Wanja, C. (2020, March 12). Tullow Oil to Sustain Kenyan Operations Despite Investment Cutbacks.

- Senelwa, K. (2019, November 2). Kenya Plans February Sale of Second Oil Shipment. Retrieved from The East African: http://www.theeastafrican.co.ke

- U.S. Energy Information Administration. (2012, July 16). Crude Oils have Different Quality Characteristics. Retrieved February 20 , 2020, from Energy Information Administration: https://www.eia.gov

- Wall Street Journal Graphics. (2016, April 15). Barrel Breakdown. Retrieved from Wall Street Journal : http://graphics.wsj.com/oil-barrel-breakdown/

- World Bank. (2020, October 5). World Bank Data.

The Viability of Turkana Oil

| Post date: Fri, Oct 16, 2020 | | Category: General | | By: Emmanuel Wa-Kyendo, |

In 2012, Kenya’s oil discoveries were greeted with nationalist fervor. Pundits, officials, and their surrogates played avatar to the proposition that Kenya’s economic wants would soon be fulfilled by an oil bonanza. Some were inspired to prepare for a migration of labor and capital into oil production. Others erred towards caution. Others still expressed the nationalist wish that Kenya’s oil find would exceed that of neighboring Uganda. Kenya would soon be like Dubai, an oil wealth exemplar, and favorite vacation haunt of the well-heeled. Were their well-intentioned hopes misplaced?

In the face of global economic strife, the state of Kenya’s foreign exchange reserves is not too good. Depressed oil prices bode ill for marginal oil producers. The nation’s public budget is also not quite under control. Foreign exchange reserves are important for the contribution they make towards meeting a country’s foreign currency obligations. These are generated through export sales made in foreign currency and foreign currency injections in the form of investments and or remittances. Kenyan oil was to contribute to foreign currency earned through exports. More broadly, economic activity is an important determinant of both public revenues and foreign exchange reserves. Many hoped that Kenyan oil would have a positive multiplier effect on the economy. At times, those who spoke in hyperbole did not support their statements with statistics. I attempt to contribute to this discussion with a simple analysis by asking just how viable Kenyan oil is?

Part I: The Quality and Quantity Of Turkana Oil

How Is the Quality of oil Determined?

At present, Kenya’s oil extraction efforts are centered around oil wells located in Lokichar, Turkana county. We will refer to this oil as Turkana crude.

Generating profits is a matter of optimizing price and cost. Alongside the oil quantum, the quality of oil is an important determinant of production cost. Among many other qualities, oil is graded by density and Sulphur content. Chart 1 above is a matrix of oil density and Sulphur content. Density is graded in ‘light’ and ‘heavy’ terms whereas Sulphur content is graded in ‘sweet’ and ‘sour’ terms. In general, a high volume of impurities and a high weight make it more difficult to extract oil. Difficulty in extraction raises extraction costs. Chart 1 above shows that Algerian and Malaysian oil are the sweetest and lightest in the world.

Experts hold that Kenya’s Lokichar crude is light and sweet with an API of 32-38 and sulfuric content below 0.5%. The quality of Kenya’s Lokichar crude is at parity with UK Brent oil. Importantly, Kenya’s oil has a 40% waxy content . If not kept at temperatures above 40 degrees Celsius, the waxiness of this oil reduces its viscosity. This drives up transportation costs as pipelines and trucks must be specially equipped to keep the oil at a desirable temperature. The relative impurity of Kenyan oil can be inferred.

Interestingly, the same experts reveal that the first batch of Kenyan oil exports were sold at a discount of US$2 per barrel relative to the UK Brent Blend.

Kenya is unlikely to be an Oil Market Maker

A barrel is a standard unit used by the oil industry. A barrel holds 159 liters of crude oil.

Economically viable oil reserves are classified as proven. The 2020 British Petroleum (BP) Statistical Review of World Energy estimates placed the worlds proved reserves at 1733.9 billion barrels at end of 2019. By 2019, Venezuela had the largest reserves in the world. Libyan oil reserves were the largest on the African continent.

By end of 2019, Africa had 125 billion barrels or 7.2% of the world’s quantum of proved reserves. South Sudan had 3.5 billion barrels . Kenya’s 560 million barrels gave it a small 0.032% share of the world’s reserves .

For the purposes of scale, a typical office has a 20 liter water dispenser. Imagine a glass that can hold about 250ml of water, leaving room to prevent spills. If that 20 liter water dispenser represents the worlds proved reserves of oil, Kenyan oil would account for 6 milliliters or 2.5% of a 250 ml glass of water. In the global market for crude, Kenya cannot be a market maker.

Finally, were each of Kenya’s 47.6 million citizens to receive an equal share of the Turkana oil, none would receive more than 10 barrels in a lifetime. The quantum of Kenya’s oil reserves is presently inconsequential.

How does Kenya’s Oil Quantum Compare with South Sudan?

Comparing Kenya’s and South Sudan’s oil quantum’s is instructive. Having gained independence in 2011, Kenya’s neighbor South Sudan is the youngest country in the world. South Sudans’ oil was an important feature of the internal conflict that saw the greater Sudan split in two. Accounting for 95.3% of the country’s exports, South Sudan is heavily dependent on oil. South Sudan is also one of the region’s most important oil producers.

Table 2 illustrates Kenya’s and South Sudan’s proved oil reserves and their life span based on the most recent production rates. Proved reserves can also be classified according to the length of time in years during which they oil can be pumped at the present extraction rate. This classification is termed the reserves to production ratio (R/P). For example, if they are pumped at their 2019 production rate of 17.5 million barrels a day, The United States of America’s proved oil reserves have an R/P ratio of 11.1 years. On the other hand, if the republic of Iran maintains an extraction rate of 3.5 million barrels a day, it will enjoy 120.6 more years of oil production.

Based on extraction rates of 80,000 and 139,000 barrels per day, Kenya and South Sudan have 19.18 and 68.99 more years respectively . To date, Kenya’s extraction rate has hovered at 2,000 barrels/day . Tullow oil, the producer of Kenya’s Turkana Crude, projected that its production would reach 80,000 barrels a day but has not attained the goal . We estimate Kenya’s R/P at this 80,000 barrels a day production rate, none the less. Importantly, the actual extraction is a telltale of viability. South Sudan has been extracting and selling its oil. Kenya’s has been stored in Mombasa. By inference, the market demand for South Sudanese oil seems to imply that their oil is more economically viable than that of Kenya.

Part II: Simulating The Production Cost and Revenues Of Kenyan Oil

In 2016, the wall street journal provided a breakdown of the production costs of a collection of crude oil products sold in the international market. It is important to note that this breakdown of the cost structure does not include a break even assessment. Each country and or company will have a break-even point determined by other costs that are not reflected by this submission by the wall street journal. Nevertheless, it is an instructive illustration about the global differences in the economic obstacles to oil extraction.

Table 3 illustrates the cost of producing a barrel of oil and gas in 2016. In 2016, the Wall Street Journal estimated that British Brent Crudes’ US$44.33 made it the most expensive of the highest volume crude oil products. Iranian and Saudi Arabian oil were among the cheapest to extract. This Their quantum and ease of extraction make Saudi and Iranian oil extremely efficient to extract. Though these estimates are dated, Saudi and Iranian oil remain among the cheapest to produce. The relative differences in oil production costs is still instructive.

Oil extraction sites are usually separate from the point of processing or export. Transportation costs feature prominently in production costs, therefore. Research firm Strata economic estimates that it in the United States it costs US$5, US$20, US$15 per barrel to transport a barrel of oil by pipeline, road and rail respectively . Kenya’s oil has been transported by road. In our model, we assume that the lower break even cost cited does not include transportation costs. The Kenyan press has indicated that Turkana crude cannot break even at prices below US$25 . Other sources have cited prices of US$50 to US$55 . Rystad, a Norwegian energy research firm estimates that in 2020, Turkana oil fields will need break even prices of US$60.65 per barrel . This seems to imply a degree of secrecy as to the actual costs of production. Putting all this together, we estimate for a US$45 per barrel cost for Kenya’s Turkana oil. Notably, this cost is still lower than the upper bound break-even price cited by some sources.

In principle, market prices that sit above production costs incentivize producers to increase supply. Supply decreases with decreases in market price. Furthermore, a producers break-even point bears a considerable bearing on the output level decision. Saudi Arabian crude oil are an important facilitator of the Saudi social contract. Analyst Andrew Hecht estimates that despite low production costs, the central role of petrodollars has driven break even costs of Saudi oil to US$80 dollars.

The true breakeven cost of Turkana crude oil remains unavailable as of this writing. In August 2019, Kenya sold its first export of 200,000 barrels of this oil at a price of US$60 per barrel. Turkana oil is extracted almost 800 kilometers away from the port of Mombasa – the closest port. Oil tankers impose minimum loading requirements for crude oil. A long distance from port and low production rates combined forced the producer to stock the 200,000 barrels over a matter of months before they met tanker requirements. Turkana crude oil becomes solid at temperatures below 40 degrees Celsius. Whatever the actual production costs may be, Turkana crudes’ waxy content imposes a requirement that oil transportation methods – whether by road or pipeline – include costly heating mechanisms. It seems that no matter how one looks at it, Turkana crude does not rank among the cheapest to produce.

Turkana Crude Revenue Simulation

Having illustrated the difficulty in producing Kenyan oil, a breakdown of production costs would allow us to arrive at an estimate of the economic viability of this oil. We approach this calculation in two ways. The first approach simulates the net revenues of Turkana crude at recent oil prices. The second approach simulates the revenues that can be generated at different profit margins.

How Might Turkana Crude Compare with UK Brent Crude and Saudi Crude?

The table above illustrates the oil prices of a collection of products of 5th October, 2020. The data is provided by ‘Oil Price’, a firm providing up to date oil market data . We use the data to build a simulation of the revenues that can be generated from Kenya’s Turkana Crude.

We use the production cost structures supplied by the Wall Street Journal in 2016 to simulate the revenues generated by UK Brent, Saudi and Turkana crude oil. For lack of better estimates, we assume that it is authoritative. UK Brent is chosen for the reason that Turkana crude oil is most similar to it. The first export of Turkana crude was marked against the price of UK Brent . Saudi Arabia is chosen to emphasize the effect of a high quantum of reserves and low production costs on revenues. At the time of this writing, more up to date sources on oil production cost structures were not freely available. Finally, the operators of Kenya’s Turkana oil fields have expressed their desire to extract 80,000 barrels of crude oil per day . To date, they have only managed to extract 2,000 barrels per day.

Saudi oil is generally an efficient and highly profitable crude oil product. On the other hand, Turkana crude requires much higher oil prices to generate profits. The 2019 sale of 200,000 barrels at US$60 per barrel demonstrates as much . The sale generated a reported $14 million in revenues.

This simulation is a sufficient representation of reality because it is generally observed that large oil producers will continue to produce at a loss. Presumably, it is better to keep a large oil extraction operation running than to shut it down. Global oil price fluctuations pose strategic difficulties for small producers. Turkana oil well strategy is constricted by its small quantum, distance from the port of export, and minimum quantity requirements to secure room on an oil tanker. Thus far, the operator has countered this difficulty by stocking product, locking in a price from a specific consumer and then shipping when the stock is full . The strategy has been employed on a single sale alone . Our analysis demonstrates the sensitivity of this small producer to price fluctuations. When compared to a smaller cutter, a large cruise ship needs more runway to take off and land and clearer waters to maneuver.

Honeymoon Analysis

Crude oil sales can generate foreign reserves, tax revenues and cash windfalls. Combined, these sums can contribute to Kenya’s efforts to industrialize and develop. The excitement about crude oil bounties may have been genuine if unrealistic. In our simulation, we suppose that the future portends something of an everlasting honeymoon. In our honeymoon analysis, we assume that Turkana crude oil sells at a profit margin of USUS$10 per barrel for 25 years, the estimated lifespan of Turkana oil wells . If the USUS$10 per barrel margin was a share of the US$60 per barrel price on which the first batch of Turkana Crude oil was sold, it would represent a 16.67% profit. This is a large margin compared to the average profits earned by big oil that amount to just about 6.7%. Our simulated profit margin would represent quite the honeymoon.

The World Bank estimates that Kenya’s GDP was US$78 billion in 2017 . The Observatory Economic Complexity estimated the value of Kenyan exports at US$6.17 billion in 2017 . Under our honeymoon conditions a daily production rate of 2,000 barrels per day would generate annual revenues that would make up a 2% share of annual exports. Revenues generated over a 25-year period still do not compare favorably relative to the value of one years’ worth of exports let alone GDP.

Kenya’s is an agrarian economy. Tea is Kenya’s most valuable export. Kenyan exports in tea alone were valued at an approximate US$1.33 billion in 2017. This is greater than the annual revenues that Turkana crude oil would generate under our simulated conditions.

Whichever way one looks at it, Kenya’s oil does not represent a sea change in the country’s fortunes.

How Might Different Profit Margins Affect Turkana Crude Revenues?

Table 6 above illustrates a simulation of the Kenya Early Oil Pilot Scheme. As the name suggests, the Kenya Early Oil Pilot Scheme or EOPS is an effort to test the market for Kenya’s crude. Keen to see to it that the revenues benefit the community, the Kenyan government generated a revenue sharing formula. Presented above is the formula. This formula assumes that producer firms own revenues have been deducted.

We assume a US$10 margin on each barrel. US$10 per barrel margin assumption after producers royalties have been deducted is more than ample. We estimate that on a US$60 barrel, this is larger than the 6.7% margin that big oil commands .

The Kenya EOPs has been pumping 2,000 barrels a day. Assuming a US$10 margin on each barrel would generate total annual revenues of US$7,300,000. The national government would earn 75% of this share or US$5,475,000. Turkana county would earn US$1,460,000 annually. The local community would itself be entitled to US$365,000. The 2019 Kenya National Bureau of Statistics Population and Household survey revealed that Turkana’s 2019 population was 926,976 . Were each of these residents to receive an equal share of the revenue as presented above, they would earn US$0.39 or Kshs 40 annually.

In August 2019, the oil stock at Mombasa port was packed up and exported. This would mark Kenya’s first exports in petroleum. The quantum of that stock was 200,000 barrels . If Turkana Crude were fetching US$35 per barrel, revenues would be around US$7,000,000. Turkana residents would barely earn a dollar each from this sale.

Notably, Kenyan oil must be stored in Mombasa until it can be exported in batches of 200,000 barrels or more. This particular constraint is placed by tanker specifications. It is unprofitable to load a tanker with a lower quantum than this. For its first export batch, Tullow oil resolved this problem by prearranging a delivery contract with the buyer, ChemChina UK Ltd. Tullow oil is likely to maintain similar arrangements in the near future.

As far as the objective of maintaining a profitable operation is concerned, the entrepreneurs on the ground know their costs better than we do. All we can ascertain is that the revenues generated in 2019s US$14,000,000 sale future exports would barely raise the per capita earnings of each Turkana resident .

Conclusion

Turkana crude is small in quantity and of a quality that increases extraction challenges and costs. These two factors make for a crude oil that is markedly inefficient to produce.

Based on the quantity of proven reserves and the quality of the crude oil, it is highly unlikely that Kenya would become a market maker. It must take the prices that the markets set. In the region, the economic viability of South Sudan’s oil has been proven to a greater degree than that of Kenya. The markets have demonstrated as much.

Road transportation is an important component of the cost of Turkana crude oil production. It is not industry practice to transport crude oil for long distances by road. Pipelines are more cost effective. Unfortunately, Kenya’s plans to build a pipeline together with Uganda has fallen apart.

In the short run, Kenya will continue to export its oil by stocking it in the port, securing a single buyer and then exporting when the stock meets oil tanker requirements.

Our simulations have been made with assumptions that might be closer to ample than they are to plausible. In the best of cases, Kenya’s oil revenues are inconsequential relative to GDP and exports. When economic growth is taken into consideration, the insignificance of Turkana crude relative to the nation’s economy is made increasingly apparent.

All in all, if there ever is an oil driven Dubai in the Savannah, it will certainly not be built from the wealth generated by EOPs or any further developments of Turkana Crude.

Bibliography

- Akinosho, T. (2020, April 29). Kenya Makes $14 Million from ‘Trickles’ of Oil Export. Retrieved from Africa Oil Gas Report: http://africaoilgasreport.com

- British Petroleum. (2020). Statistical Review of World Energy, 2020. British Petroleum.

- Fawthorp, A. (2020, April 16). How will Africa be affected by the Oil Industry’s Capital Investment Cuts? Retrieved from NS Energy: http://www.nsenergybusiness.com

- Gupte, E. (2019, August 27). Kenya Exports First Crude Cargo, Boosting oil Ambitions. Retrieved from Standard and Poors Global: www.spglobal.com

- Hansen, M. E., & Dursteler, E. (2017). Economic, Environmental and Safety Impacts of Transporting Oil and Gas in the U.S. .

- Hansen, M. E., & Dursteler, E. (n.d.). Pipelines, Rail and Trucks. Strata Economic.

- Houreld, K. (2016, October 7). Kenya Oil Official Sees Break-Even Price at $50-55 per Barrel. Retrieved from Reuters: http://www.reuters.com

- Karambu, I. (2016, February 11). We can’t Break Even at Less than $25 a Barrel, says Tullow. Retrieved from Nation Media: http://www.nation.africa

- Kenya National Bureau of Statistics. (2019). 2019 Population and Housing Census . Kenya National Bureau of Statistics.

- Kenya National Bureau of Statistics. (2020). Kenya Economic Survey 2020. Kenya National Bureau of Statistics.

- Markey, D. (2020, October 5). Big Oil Industry’s Profit Percent Average. Retrieved from Smallbusinesschron: http://www.smallbusiness.chron.com

- Observatory Economic Complexity. (2020, October 5). Kenya.

- Oil Price. (2020, August 31). Oil Price Charts. Retrieved from Oil Price: https://oilprice.com/oil-price-charts/block/1

- Okoth, E. (2020, February 9). Tullow Job Cuts in Kenya Deepen Oil Export Doubts. Retrieved from The East African: http://www.theeastafrican.co.ke

- Owili, R., & Wanja, C. (2020, March 12). Tullow Oil to Sustain Kenyan Operations Despite Investment Cutbacks.

- Senelwa, K. (2019, November 2). Kenya Plans February Sale of Second Oil Shipment. Retrieved from The East African: http://www.theeastafrican.co.ke

- U.S. Energy Information Administration. (2012, July 16). Crude Oils have Different Quality Characteristics. Retrieved February 20 , 2020, from Energy Information Administration: https://www.eia.gov

- Wall Street Journal Graphics. (2016, April 15). Barrel Breakdown. Retrieved from Wall Street Journal : http://graphics.wsj.com/oil-barrel-breakdown/

- World Bank. (2020, October 5). World Bank Data.

More News

52 ECONOMIC FALLACIES

The Institute of Economic Affairs (IEA-Kenya) has made a compilation of 52 essays that refutes common statements about the Kenyan economy that lack sound Economic rationale.

IEA-Kenya tops list of Think Tanks in Sub Saharan Africa Region in Global Index Report

The Institute of Economic Affairs (IEA Kenya) has emerged as one of the top Think Tanks in Kenya and Sub Saharan Africa, according to the 2020 Global Index Report by the Lauder Institute of the University of Pennsylvania. The ranking identifies think tanks that excel in research, analysis and public engagement on a wide range […]

Media Briefing on the Implementation of the national government budget 2019/20: Implication of gaps and deviations?

Friday, 06 November 2020: The Institute of Economic Affairs (IEA-Kenya) in partnership with the National Democratic Institute (NDI) held a media briefing to discuss the “Implementation of the national government budget FY 2019/20: Implication of gaps and deviations?” The findings and evidence generated from the analysis of budget oversight documents will be used to establish […]

The 3rd Basis for Revenue Sharing among County governments – Rationale, Politics, Future of the Formula

Monday, August 3, 2020: The Institute of Economic Affairs (IEA-Kenya) held a virtual public forum on The 3rd Basis for Revenue Sharing among County governments – Rationale, Politics, Future of the Formula. The discussion mainly focused on county budget allocation, expenditure and delivery. On implementation of the third basis, the Commission on Revenue Allocation (CRA) […]

Covid-19 Pandemic Might Decelerate Efforts to attain Universal Health Coverage by 2022

The Constitution of Kenya, 2010 created a two-tier governance system with national and county government elements. Embedded within the constitution are interdependent government functions. Health sector responsibilities are shared between the two tiers of government. The National Government is charged with policy formulation, planning and budgeting, capacity building, health research and quality assurance. Health service […]