Evaluating Kenya’s Tax Law Changes on PAYE in January 2021

Category: General

By: Annah-Grace Kemunto,

There have been several changes in Kenya’s personal income tax – Pay As You Earn (PAYE)- laws between the years 2019 and 2021 partly due to the economic shocks brought about by the Covid-19 pandemic. This blog post discusses the effects of these policy changes on the progressivity of the tax code and on individual income earners.

The Effects on Progressivity of the Tax Code:

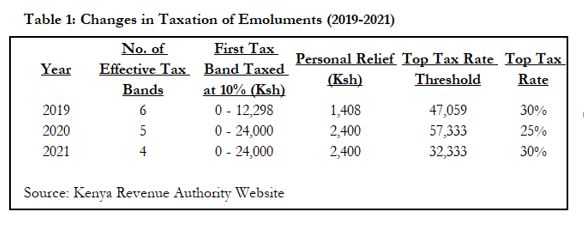

A tax band is the range of income for which a tax rate is charged. In the first tax band an individual’s maximum PAYE tax liability is lower than their personal relief. Therefore, creating a 0% effective tax rate for income earners within the first tax band. Income earners in the first tax band still however must file nil tax returns every year. Making the distinction between a tax band and an effective tax rate explains why the number of effective tax rates in each year is always one more than the number of tax bands. Nevertheless, since 2019, there has been a consistent and intentional reduction of the number of tax bands from 6 to 4, as seen in Table 1 above, which has made the Kenyan tax system less complicated when it comes to ease of computation of taxes. The fewer tax bands also mean that the tax code has become less progressive in the sense that there are fewer distinctions in tax bands and tax rates as the taxable income increases.

Effective April 2020 the minimum monthly taxable income was raised to Ksh. 24,000 from Ksh. 12,298. The calculations show an additional 717,497 taxable persons were now being taxed at 0%. In 2021 the maximum monthly income charged at the zero-tax rate remained unchanged at Ksh. 24,000. In 2019 there were about 49,747 (1.7%) formal sector workers paying the 0% effective tax rate. With the resizing of the first tax band, this number has grown to 767,244 (26.2%). What this means is that an additional 24.5% of the formal sector income earners are relieved from paying personal income tax.

The tax burden for this 26.2% of formal sector workers has shifted from both income and consumption taxes towards consumption taxes.

Top Tax Rate Changes:

Column five of Table 1 explains the changes in the monthly income above which the top tax rate in column six is applicable. In 2020, the monthly income above which the top tax rate was applicable rose from Ksh. 47,059 to Ksh. 57,333. This 21.8% increase meant that it took an additional Ksh. 10,274 for an income earner to make it to the highest tax band in 2020. This was another measure taken with the intent of cushioning income earners from the economic shocks brought about by Covid-19. However, in 2021 the top tax rate threshold has been depressed even further than it was in 2019. The top tax rate threshold has been reduced to Ksh. 32,333, therefore, quickening one’s progression to the highest tax band. What this means is that a worker earning Ksh. 32,334 is taxed at the same rate as the highest-paid individual in the republic.

If the highest tax band was a show, reducing the top tax rate threshold reduces the cost of a ticket to the show effectively raising the size of the audience which is the number of taxable persons being paying at the highest rate.

Secondly, the median income (2019) of formal sector workers in Kenya is Ksh. 32.832. This is Ksh. 500 above the top tax rate threshold. The effect of the reconstruction of the tax bands is that about half of the total number of taxable persons have been graduated to the highest taxed band for which an effective tax rate of 30% is applied. In addition to this, the formal sector average income, Ksh. 41,966, is already paying the top tax rate.

Illustrative Simulations:

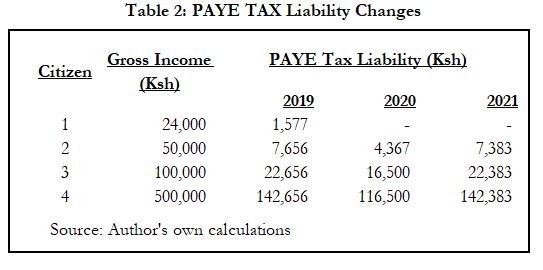

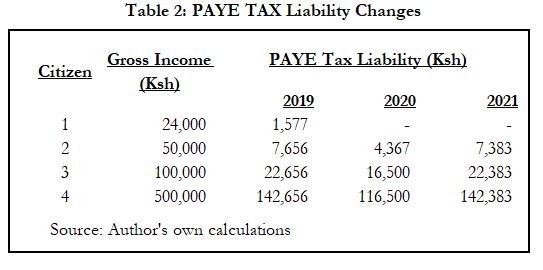

We have examined the PAYE tax law changes and what they mean for the various tax bands. But what does it mean for overall PAYE tax liability? Table 2 below tracks four different income levels and their respective tax liabilities over the last three years. Worth noting is how for all four income levels, the PAYE tax liability in 2020 was a significant reduction from 2019 especially for those with lower incomes. Citizen 1 earning Ksh. 24,000 received 100% income tax relief on their gross income. Citizen 2 earning Ksh. 50,000 a month had a tax liability reduction of 43% in 2020 whereas the one earning Ksh. 500,000 experienced an 18% PAYE tax liability reduction. This was in line with the Kenyan government’s intention to cushion lower-income earners from the adverse economic effects of the Covid-19 pandemic. Common for all three income levels, the PAYE tax liability in 2021 rose from that in 2020 but slightly lower than that in 2019.

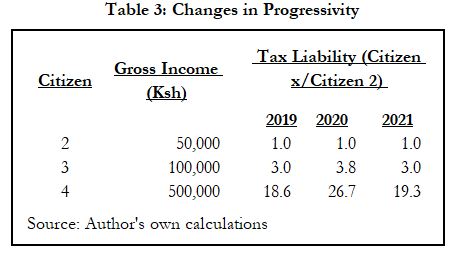

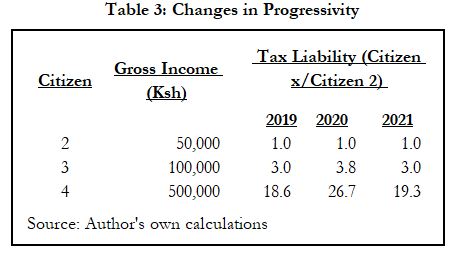

Generally, Kenya’s income tax system is progressive – the higher the income earned by an individual, the higher their tax liability. However, the level of progressivity has changed over the three years under review. Table 3 below shows the PAYE tax liability across three income levels as a proportion of the lowest PAYE tax liability (Citizen 2) thus painting the picture of how progressive the Kenyan personal income tax code has evolved. Column 3 of Table 3 explains that in 2019, a formal sector worker earning Ksh. 500,000 a month had a tax liability 18.6 times that of the individual earning Ksh. 50,000. In 2020, at the height of the Covid-19 pandemic, this proportion grew to 26.7. In 2021, the progressivity ratio has declined to 19.3, still higher than it was in 2019, prior to Covid-19. This means that for every person earning Ksh. 500,000 it would take about 20 people earning Ksh. 50,000 to match their income tax liability.

The increase in the progressivity is the resultant of two changes: reducing the PAYE tax base by reducing the number of formal sector workers effectively paying taxes by about 24.5 percentage points and lowering the top tax rate threshold. Since tax bands are arbitrarily set the number of people the Kenyan government can award 100% income tax relief will depend on how fast higher incomes grow in turn affecting the level of progressivity. This could however be solved by imposing a proportional tax also known as a flat tax whereby the tax rate is the same whether the taxable amount increases or decreases.

In conclusion, the tax system in 2021 is now less complex compared to 2019 due to the reduction of tax bands. The number of direct taxpayers has significantly reduced from 98.3% to 73.8% of formal sector workers based on the number of income earners in 2019. There is a notable tradeoff between the complexity and progressivity of the tax system.

More Blogs

Tax 101: Tariffs are taxes

There is a big global debate on tariffs, their effects, and who pays for them, creating misconceptions. The broader trade strategy premised on Tariffs reflects a worldview rooted in 19th-century mercantilism, emphasizing protectionism and an aggressive use of tariffs.[1] The misconception that tariffs aren’t taxes stems from several factors. Framing plays a significant role. Tariffs […]

Law and Economics of Occupational Licensing: The Case of Law Profession

Occupational licensing is widespread in Kenya, particularly in professions such as law and medicine, and it sparks debate in law and economics. In Kenya, occupational licensing is provided for through a set of statutes. This has implications for markets of legal service provision, which we discuss in this blog. Why is occupational licensing now a […]

Mr. Trump and Kenya’s Macro

It has always been difficult to tie Mr. Trump’s statements to his subsequent policy actions. That fact qualifies any certainty in discerning his implications for Kenya’s macro now. But in three areas, the Kenyan macroeconomic authorities should be on high alert. The Kenya Shilling For much of 2024, the Central Bank of Kenya (CBK)has been […]

Is Kenya’s Tax System Efficient, Optimal, and Equitable?

In my new paper, “On Efficiency, Equity, and Optimal Taxation: Reforming Kenya’s Tax System,” I examine Kenya’s tax system through the lenses of efficiency, equity, and optimality and recommend policy recommendations. I try to look at how efficiently the system generates revenue without distorting economic activity (efficiency), how fairly the tax burden is distributed across […]

Gen Z Collective Action on Taxation and Economic Policy.

Introduction The Finance Bill 2024 in Kenya sparked a wave of collective action primarily driven by Gen Z, marking a significant moment for youth engagement in Kenyan politics. This younger generation, known for their digital fluency and facing bleak economic prospects, utilised social media platforms to voice their discontent and mobilise protests against the proposed […]

Evaluating Kenya’s Tax Law Changes on PAYE in January 2021

| Post date: Fri, Mar 19, 2021 |

| Category: General |

| By: Annah-Grace Kemunto, |

There have been several changes in Kenya’s personal income tax – Pay As You Earn (PAYE)- laws between the years 2019 and 2021 partly due to the economic shocks brought about by the Covid-19 pandemic. This blog post discusses the effects of these policy changes on the progressivity of the tax code and on individual income earners.

The Effects on Progressivity of the Tax Code:

A tax band is the range of income for which a tax rate is charged. In the first tax band an individual’s maximum PAYE tax liability is lower than their personal relief. Therefore, creating a 0% effective tax rate for income earners within the first tax band. Income earners in the first tax band still however must file nil tax returns every year. Making the distinction between a tax band and an effective tax rate explains why the number of effective tax rates in each year is always one more than the number of tax bands. Nevertheless, since 2019, there has been a consistent and intentional reduction of the number of tax bands from 6 to 4, as seen in Table 1 above, which has made the Kenyan tax system less complicated when it comes to ease of computation of taxes. The fewer tax bands also mean that the tax code has become less progressive in the sense that there are fewer distinctions in tax bands and tax rates as the taxable income increases.

Effective April 2020 the minimum monthly taxable income was raised to Ksh. 24,000 from Ksh. 12,298. The calculations show an additional 717,497 taxable persons were now being taxed at 0%. In 2021 the maximum monthly income charged at the zero-tax rate remained unchanged at Ksh. 24,000. In 2019 there were about 49,747 (1.7%) formal sector workers paying the 0% effective tax rate. With the resizing of the first tax band, this number has grown to 767,244 (26.2%). What this means is that an additional 24.5% of the formal sector income earners are relieved from paying personal income tax.

The tax burden for this 26.2% of formal sector workers has shifted from both income and consumption taxes towards consumption taxes.

Top Tax Rate Changes:

Column five of Table 1 explains the changes in the monthly income above which the top tax rate in column six is applicable. In 2020, the monthly income above which the top tax rate was applicable rose from Ksh. 47,059 to Ksh. 57,333. This 21.8% increase meant that it took an additional Ksh. 10,274 for an income earner to make it to the highest tax band in 2020. This was another measure taken with the intent of cushioning income earners from the economic shocks brought about by Covid-19. However, in 2021 the top tax rate threshold has been depressed even further than it was in 2019. The top tax rate threshold has been reduced to Ksh. 32,333, therefore, quickening one’s progression to the highest tax band. What this means is that a worker earning Ksh. 32,334 is taxed at the same rate as the highest-paid individual in the republic.

If the highest tax band was a show, reducing the top tax rate threshold reduces the cost of a ticket to the show effectively raising the size of the audience which is the number of taxable persons being paying at the highest rate.

Secondly, the median income (2019) of formal sector workers in Kenya is Ksh. 32.832. This is Ksh. 500 above the top tax rate threshold. The effect of the reconstruction of the tax bands is that about half of the total number of taxable persons have been graduated to the highest taxed band for which an effective tax rate of 30% is applied. In addition to this, the formal sector average income, Ksh. 41,966, is already paying the top tax rate.

Illustrative Simulations:

We have examined the PAYE tax law changes and what they mean for the various tax bands. But what does it mean for overall PAYE tax liability? Table 2 below tracks four different income levels and their respective tax liabilities over the last three years. Worth noting is how for all four income levels, the PAYE tax liability in 2020 was a significant reduction from 2019 especially for those with lower incomes. Citizen 1 earning Ksh. 24,000 received 100% income tax relief on their gross income. Citizen 2 earning Ksh. 50,000 a month had a tax liability reduction of 43% in 2020 whereas the one earning Ksh. 500,000 experienced an 18% PAYE tax liability reduction. This was in line with the Kenyan government’s intention to cushion lower-income earners from the adverse economic effects of the Covid-19 pandemic. Common for all three income levels, the PAYE tax liability in 2021 rose from that in 2020 but slightly lower than that in 2019.

Generally, Kenya’s income tax system is progressive – the higher the income earned by an individual, the higher their tax liability. However, the level of progressivity has changed over the three years under review. Table 3 below shows the PAYE tax liability across three income levels as a proportion of the lowest PAYE tax liability (Citizen 2) thus painting the picture of how progressive the Kenyan personal income tax code has evolved. Column 3 of Table 3 explains that in 2019, a formal sector worker earning Ksh. 500,000 a month had a tax liability 18.6 times that of the individual earning Ksh. 50,000. In 2020, at the height of the Covid-19 pandemic, this proportion grew to 26.7. In 2021, the progressivity ratio has declined to 19.3, still higher than it was in 2019, prior to Covid-19. This means that for every person earning Ksh. 500,000 it would take about 20 people earning Ksh. 50,000 to match their income tax liability.

The increase in the progressivity is the resultant of two changes: reducing the PAYE tax base by reducing the number of formal sector workers effectively paying taxes by about 24.5 percentage points and lowering the top tax rate threshold. Since tax bands are arbitrarily set the number of people the Kenyan government can award 100% income tax relief will depend on how fast higher incomes grow in turn affecting the level of progressivity. This could however be solved by imposing a proportional tax also known as a flat tax whereby the tax rate is the same whether the taxable amount increases or decreases.

In conclusion, the tax system in 2021 is now less complex compared to 2019 due to the reduction of tax bands. The number of direct taxpayers has significantly reduced from 98.3% to 73.8% of formal sector workers based on the number of income earners in 2019. There is a notable tradeoff between the complexity and progressivity of the tax system.

More Blogs

Tax 101: Tariffs are taxes

There is a big global debate on tariffs, their effects, and who pays for them, creating misconceptions. The broader trade strategy premised on Tariffs reflects a worldview rooted in 19th-century mercantilism, emphasizing protectionism and an aggressive use of tariffs.[1] The misconception that tariffs aren’t taxes stems from several factors. Framing plays a significant role. Tariffs […]

Law and Economics of Occupational Licensing: The Case of Law Profession

Occupational licensing is widespread in Kenya, particularly in professions such as law and medicine, and it sparks debate in law and economics. In Kenya, occupational licensing is provided for through a set of statutes. This has implications for markets of legal service provision, which we discuss in this blog. Why is occupational licensing now a […]

Mr. Trump and Kenya’s Macro

It has always been difficult to tie Mr. Trump’s statements to his subsequent policy actions. That fact qualifies any certainty in discerning his implications for Kenya’s macro now. But in three areas, the Kenyan macroeconomic authorities should be on high alert. The Kenya Shilling For much of 2024, the Central Bank of Kenya (CBK)has been […]

Is Kenya’s Tax System Efficient, Optimal, and Equitable?

In my new paper, “On Efficiency, Equity, and Optimal Taxation: Reforming Kenya’s Tax System,” I examine Kenya’s tax system through the lenses of efficiency, equity, and optimality and recommend policy recommendations. I try to look at how efficiently the system generates revenue without distorting economic activity (efficiency), how fairly the tax burden is distributed across […]

Gen Z Collective Action on Taxation and Economic Policy.

Introduction The Finance Bill 2024 in Kenya sparked a wave of collective action primarily driven by Gen Z, marking a significant moment for youth engagement in Kenyan politics. This younger generation, known for their digital fluency and facing bleak economic prospects, utilised social media platforms to voice their discontent and mobilise protests against the proposed […]