Membership in the National Hospital Insurance Fund

Membership in the National Hospital Insurance Fund

| Post date: Fri, May 25, 2018 | | Category: Health | |

The National Health Insurance Scheme is a form of national health insurance established by the Government of Kenya under the National Hospital Insurance Act (1998) cap 255, with a goal of providing equitable access and financial coverage for basic health care services to Kenyan citizens.

The significance of a National Health Insurance Scheme to a nation cannot be overemphasized, among the big four agenda by the Jubilee government, in pursuit of universal access to healthcare for all Kenyans, plans to increase the cover to ensure all Kenyans have access to affordable health insurance. To this end, the government intends to restructure the National Hospital Insurance Fund to eliminate corruption and bureaucracy; roll out a community health network across the country and raise the government’s budget allocation to health from 6% to 10%.

Implementation of universal health coverage (UHC) is highly welcome and is hoped to cushion especially the low-income groups from high risks that arise from the shocks that they occasionally face during disease epidemics.

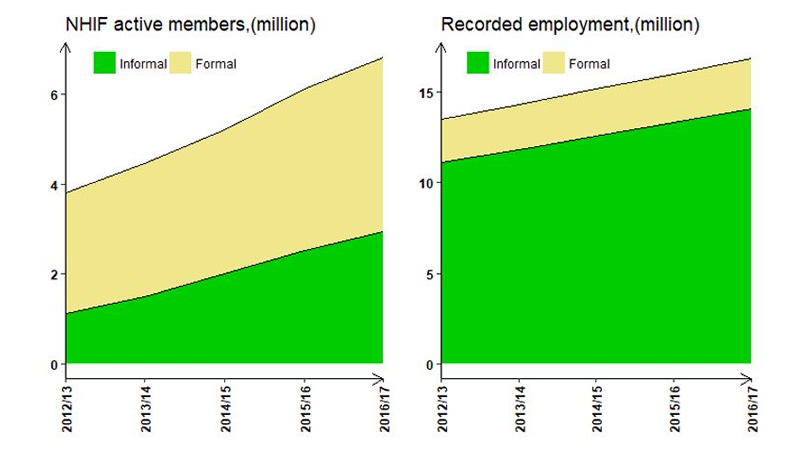

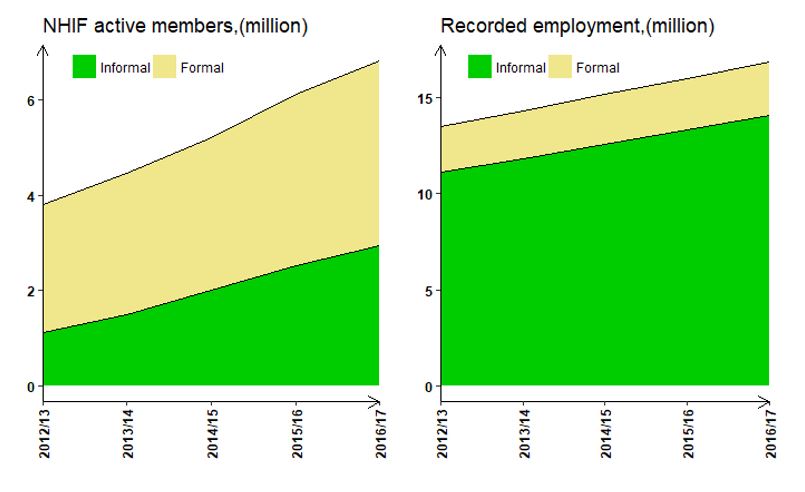

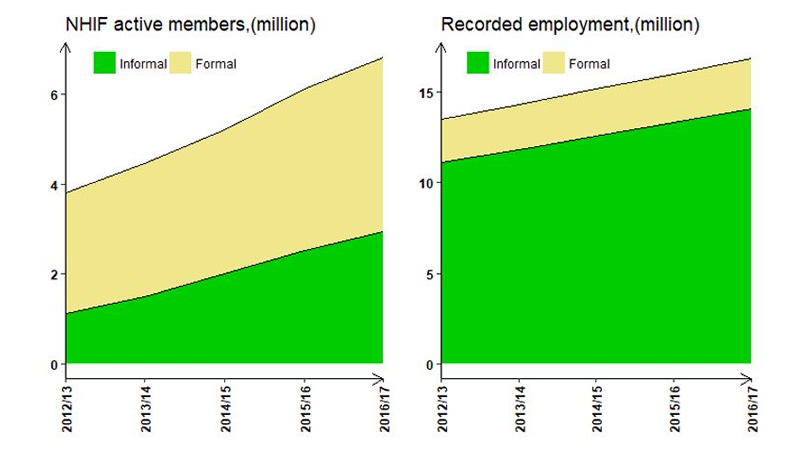

The recent government statistics reveal a gap in terms of registered members of the national insurance cover. As shown in the chart below, the membership is still low. In 2016/17 total membership was 6.8 million out of which 56% constitute membership from formal sector while 44% constitute membership from informal sector. When these numbers are contrasted with employment in the formal and informal sector, it is shown that out of the total 16.8 million employees in 2016/17, informal employment constitutes, 83%, thus disclosing that a significant number of the Kenyans in informal sector do not have NHIF cover.

NHIF membership versus recorded employment

Source: KNBS | Economic Survey 2018

Number of the Week: 80%

- Active members covered by national hospital insurance fund increased from 3.8 million in 2012/13 to 6.8 million in 2016/17

- Over the same period active members in informal sector increased from 1.1 million to 2.9 million, representing a proportion of 29% and 44% respectively. This implies that NHIF coverage in informal sector is low but growing at a faster pace compared to the coverage in the formal sector.

- Total active NHIF membership as a share of total employment in 2016/17 constitutes 40% thus implying that two thirds of the employed Kenyans do not have NHIF cover.

- Out of the two thirds of the employed Kenyans who do not have NHIF cover, 80% are from the informal sector

More Number of the Week

Kenya’s comparison of Out of pocket expenditure on Health with its peers

In the advent of increased Non-Communicable Diseases such as cancer that require long time treatment, reduction of the Out-of-pocket payments is key in sustaining affordability and access to health care services. These can be achieved through increased insurance both by the government and the private sector.

Outstanding Stock of Treasury Bonds by Holders

Treasury bonds are a secure, medium- to long-term investment tools that typically offer periodic interest payments semiannually throughout the bond’s life. The Central Bank auctions Treasury bonds on a monthly basis, but offers a variety of bonds throughout the year, so prospective investors should regularly check for upcoming auctions. Outstanding Treasury Bonds increased by 11.2 per cent to Ksh 1,152,041 million in June 2016 from Ksh 1,035,662 million in June 2015.

Outstanding Stock of Treasury Bills by Holders

In June 2016 compared to June 2015, the stock of Treasury bills increased by 84.4 per cent to Ksh 588,088 million from Ksh 318,929 million while the proportion held by commercial banks increased by 67.4 per cent to Ksh 361,859 million from Ksh 217,742 million. In the same period, holdings by pension fund institutions increased to 20.1 per cent from 12.8 per cent while proportion held by insurance companies decreased to 3.1 per cent from 6.5 per cent.

Outstanding Stock of Treasury Bills and Bonds by Holders

The medium term debt strategy for the financial year 2016/17 emphasized on the need to develop the domestic market by increasing the issuance of Treasury bonds over the medium term. The strategy targeted a mix of 60 percent and 40 per cent for external and domestic financing, respectively.

Trends in Kenya’s Total Domestic Public Debt Stock from 1999 – 2018 (In nominal terms)

Trends in Kenya’s Total Domestic Public Debt Stock from 1999 – 2018 (In nominal terms) Source: Central Bank of Kenya The number of the Week: 2.1, this is the factor by which domestic debt has grown in the last five years. Domestic debt has nearly doubled in the last five years (2013-2018) Between 1999 and […]