Key Political Economy Issues of Kenya’s Taxation System

Category: Taxation

By: Leo Kipkogei Kemboi,

This blog highlights IEA’s most recent work on taxation, a problem-driven political economy analysis of taxation.[i] After the study’s publication, a webinar was held to discuss the findings of the political economy analysis available here. [ii]

In the introduction, the study outlines how Kenya’s tax policy faces challenges from its political ecosystem, structural factors, and the dynamic nature of tax laws and emphasizes the need for evidence-based tax code development. The Kenyan Tax Code is governed by the Constitution and several key legislations, which set out key principles and standards that should be adhered to in formulating, administering and reviewing the tax code. The study also expounds on what can be defined as optimal taxation. Optimal taxation aims to maximize social welfare while minimizing economic distortions. The study demonstrates why a tax in itself is a distortion of economic activities. The essence of applying principles of fair taxation is to reduce distortions. The Key principles include efficiency, equity, simplicity, transparency, administrative efficiency, neutrality, and flexibility. The study outlines the major concerns about Kenya’s taxation system, namely that it lacks buoyancy, does not leverage tax base growth, and has sectors that are hard to tax. The study aimed to understand the political ecosystem, factors influencing tax policy, evidence behind tax laws, incentives for optimal tax rates, information access and influence asymmetries, and formal and informal processes affecting policy changes.

The methodology involves problem identification, diagnosis, and exploration of change processes, which includes problem-driven approaches and analysis of institutional and structural factors influencing taxation.

Key Players Who Shape Tax System

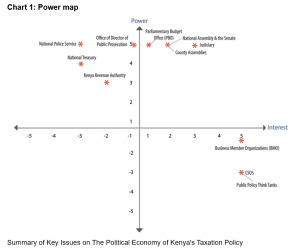

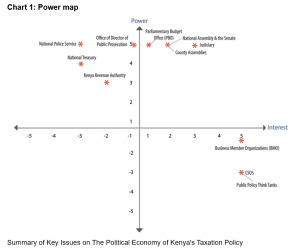

A variety of key players shape tax policy in Kenya. Parliament, consisting of the National Assembly and the Senate, passes tax laws reflecting public needs and economic goals. The National Treasury formulates economic policies and manages debt, which is crucial for an efficient tax system. The Kenya Revenue Authority (KRA) administers tax laws and collects revenue. Political parties influence tax policies through policy formulation, oversight, and representation. Business Member Organizations (BMOs) represent business interests and advocate for sector-specific policies. The Office of the Director of Public Prosecution enforces tax laws, and the National Police Service assists in enforcement. The Parliamentary Budget Office (PBO) analyses budget and taxation matters. County Assemblies pass the Finance Bill, shaping local taxation. The Judiciary resolves tax disputes and protects taxpayers’ rights. Universities and Public Policy Think Tanks conduct research, provide recommendations, and promote informed discourse on tax policy.

The stakeholder mapping illuminates the nuanced dynamics of power and interest among key institutions. Parliament (Members of the National Assembly and Senators), including the National Assembly and the Senate, emerges as a formidable force with significant power and a balanced interest. The National Treasury holds considerable power but shows potential misalignment or differing interests with other stakeholders, as indicated by its negative interest score. The Kenya Revenue Authority (KRA) wields notable power in tax-related matters but faces potential interest divergences. Business Member Organizations (BMOs) lack significant power but express a strong interest, indicating a desire for active involvement. The Office of the Director of Public Prosecution commands substantial power in legal matters, with potential interest divergences. The National Police Service, with significant power in law enforcement, encounters similar potential divergences. The Parliamentary Budget Office (PBO) holds limited power but is highly interested in economic policy matters. County Assemblies wield substantial power at the local level with balanced interest. The Judiciary is a potent force with significant power and a strong interest in legal matters. With limited power, Civil Society Organizations (CSOs) and Public Policy Think Tanks express robust interest, emphasizing their desire for active involvement. This concise analysis provides insights into power dynamics, guiding collaboration among key stakeholders.

a) Vagaries of the Finance Bill: Kenya’s Public Finance Management 2012 requires all revenue-raising measures to be in a single bill, the Finance Bill. This bill is omnibus, combining various measures which can limit scrutiny and transparency. The bill is mandated to be tabled in Parliament annually, leading to frequent revisions without proper analysis of past changes. This challenges the effectiveness and transparency of the tax system.

b) Old Constitutional PFM Norms Still Exist in the 2010 Constitution Dispensation: The Constitution of Kenya 2010 grants taxation powers to Parliament, subject to public participation, and gives the High Court the power to review tax matters. However, contrary to the Constitution, the Kenya Revenue Administration has assumed more policy-making power.

c) Mandatory Nature of Consideration of Finance Bill: The PFMA 2012 mandates the Cabinet Secretary to announce budget policy highlights and submit the Finance Bill to Parliament, which must consider and approve it within ninety days of passing the Appropriation Bill. This process ensures transparency but may limit flexibility in tax policy changes. The tax reviews should only be considered in the medium and guided by evidence.

d) Political Processes: Kenya’s tax structure is influenced by national and regional politics, with political parties and leaders shaping tax policies based on their promises and agendas, affecting the allocation of public resources.

e) Convergence between Legal, Process, and Economic Problems: The mandatory nature of the Finance Bill’s consideration annually poses challenges. Economic growth influences revenue generation, and tax changes may not yield additional revenue if the tax system lacks buoyancy and elasticity. Tax rates need to be within the Laffer curve for optimal revenue generation.

Conclusion

Kenya faces intricate challenges in tax policy, influenced by political, structural, and institutional factors, raising concerns about transparency and effectiveness. The tax code’s complexity and frequent changes require a deeper understanding. The methodology provides a comprehensive view, emphasizing problem identification and potential change processes.

Policy concerns include the use of omnibus bills impacting transparency, the alignment of old constitutional norms, and the size of the tax code. Mandatory consideration of the Finance Bill annually raises questions about the responsiveness of tax measures to economic growth.

The power map of Kenya’s tax code stakeholders reveals diverse interests and influences. Key recommendations include simplifying the tax code for Parliament, fostering collaboration between the National Treasury and Parliament, emphasizing voluntary compliance for the Kenya Revenue Authority, and championing fair tax systems for Civil Society Organizations. Transparency, fairness, and collaboration are common themes, with a shared call for a shift to predictable finance bill reviews. If implemented collaboratively, the proposed reforms can create an efficient, transparent, and development-aligned tax system for Kenya’s economic growth.

End Notes

[i] Kemboi, Leo. K., & Kagume, J. (2024). Political Economy Analysis of Taxation Policy in Kenya. Institute of Economic Affairs Kenya.

[ii] IEA Kenya. “IEA Kenya Webinar #3of2024 on the Political Economy of Taxation in Kenya.” Www.youtube.com, 16 Apr. 2024, www.youtube.com/watch?v=sHvrxlPxDmc&t=728s.

More Blogs

Gen Z Collective Action on Taxation and Economic Policy.

Introduction The Finance Bill 2024 in Kenya sparked a wave of collective action primarily driven by Gen Z, marking a significant moment for youth engagement in Kenyan politics. This younger generation, known for their digital fluency and facing bleak economic prospects, utilised social media platforms to voice their discontent and mobilise protests against the proposed […]

Two Immediate Monetary-Framework Imperatives for Mr. Mbadi

The credibility of Monetary Policy in Kenya is compromised at present by two factors: As we anticipated mid-year, inflation is headed below the target range for the first time; The 7-member Monetary Policy Committee (MPC) has four vacancies. In light of the former prospect, the MPC reduced the Central Bank of Kenya (CBK) Policy Rate, […]

Important dates and Citizen Concerns During Budget Planning Phase for Fiscal Year 2025/2026

The Budget formulation and preparation process in Kenya is guided by a budget calendar which indicates the timelines for key activities issued in accordance with Section 36 of the Public Finance Management Act, 2012.These provide guidelines on the procedures for preparing the subsequent financial year and the Medium-Term budget forecasts. The Launch of the budget […]

Adjusted IMF Program Demands on Kenya

In the IMF WEO published yesterday, the IMF elaborated its macroeconomic framework for the ongoing IMF program. The numbers clarify how the program, derailed by the mid-year Gen-Z protests, has been adjusted to make possible the Board meeting for the combined 7th and 8th Reviews scheduled for October 30. The adjustments, unfortunately, again raise profound […]

What does the Nobel Prize in Economics 2024 mean for Constitution Implementation in Kenya?

Daron Acemoglu, Simon Johnson, and James A. Robinson won the 2024 Nobel Prize in Economics for their research on how a country’s institutions significantly impact its long-term economic success.[1] Their work emphasizes that it’s not just about a nation’s resources or technological advancements but rather the “rules of the game” that truly matter. Countries with […]

Key Political Economy Issues of Kenya’s Taxation System

| Post date: Sun, May 5, 2024 |

| Category: Taxation |

| By: Leo Kipkogei Kemboi, |

This blog highlights IEA’s most recent work on taxation, a problem-driven political economy analysis of taxation.[i] After the study’s publication, a webinar was held to discuss the findings of the political economy analysis available here. [ii]

In the introduction, the study outlines how Kenya’s tax policy faces challenges from its political ecosystem, structural factors, and the dynamic nature of tax laws and emphasizes the need for evidence-based tax code development. The Kenyan Tax Code is governed by the Constitution and several key legislations, which set out key principles and standards that should be adhered to in formulating, administering and reviewing the tax code. The study also expounds on what can be defined as optimal taxation. Optimal taxation aims to maximize social welfare while minimizing economic distortions. The study demonstrates why a tax in itself is a distortion of economic activities. The essence of applying principles of fair taxation is to reduce distortions. The Key principles include efficiency, equity, simplicity, transparency, administrative efficiency, neutrality, and flexibility. The study outlines the major concerns about Kenya’s taxation system, namely that it lacks buoyancy, does not leverage tax base growth, and has sectors that are hard to tax. The study aimed to understand the political ecosystem, factors influencing tax policy, evidence behind tax laws, incentives for optimal tax rates, information access and influence asymmetries, and formal and informal processes affecting policy changes.

The methodology involves problem identification, diagnosis, and exploration of change processes, which includes problem-driven approaches and analysis of institutional and structural factors influencing taxation.

Key Players Who Shape Tax System

A variety of key players shape tax policy in Kenya. Parliament, consisting of the National Assembly and the Senate, passes tax laws reflecting public needs and economic goals. The National Treasury formulates economic policies and manages debt, which is crucial for an efficient tax system. The Kenya Revenue Authority (KRA) administers tax laws and collects revenue. Political parties influence tax policies through policy formulation, oversight, and representation. Business Member Organizations (BMOs) represent business interests and advocate for sector-specific policies. The Office of the Director of Public Prosecution enforces tax laws, and the National Police Service assists in enforcement. The Parliamentary Budget Office (PBO) analyses budget and taxation matters. County Assemblies pass the Finance Bill, shaping local taxation. The Judiciary resolves tax disputes and protects taxpayers’ rights. Universities and Public Policy Think Tanks conduct research, provide recommendations, and promote informed discourse on tax policy.

The stakeholder mapping illuminates the nuanced dynamics of power and interest among key institutions. Parliament (Members of the National Assembly and Senators), including the National Assembly and the Senate, emerges as a formidable force with significant power and a balanced interest. The National Treasury holds considerable power but shows potential misalignment or differing interests with other stakeholders, as indicated by its negative interest score. The Kenya Revenue Authority (KRA) wields notable power in tax-related matters but faces potential interest divergences. Business Member Organizations (BMOs) lack significant power but express a strong interest, indicating a desire for active involvement. The Office of the Director of Public Prosecution commands substantial power in legal matters, with potential interest divergences. The National Police Service, with significant power in law enforcement, encounters similar potential divergences. The Parliamentary Budget Office (PBO) holds limited power but is highly interested in economic policy matters. County Assemblies wield substantial power at the local level with balanced interest. The Judiciary is a potent force with significant power and a strong interest in legal matters. With limited power, Civil Society Organizations (CSOs) and Public Policy Think Tanks express robust interest, emphasizing their desire for active involvement. This concise analysis provides insights into power dynamics, guiding collaboration among key stakeholders.

a) Vagaries of the Finance Bill: Kenya’s Public Finance Management 2012 requires all revenue-raising measures to be in a single bill, the Finance Bill. This bill is omnibus, combining various measures which can limit scrutiny and transparency. The bill is mandated to be tabled in Parliament annually, leading to frequent revisions without proper analysis of past changes. This challenges the effectiveness and transparency of the tax system.

b) Old Constitutional PFM Norms Still Exist in the 2010 Constitution Dispensation: The Constitution of Kenya 2010 grants taxation powers to Parliament, subject to public participation, and gives the High Court the power to review tax matters. However, contrary to the Constitution, the Kenya Revenue Administration has assumed more policy-making power.

c) Mandatory Nature of Consideration of Finance Bill: The PFMA 2012 mandates the Cabinet Secretary to announce budget policy highlights and submit the Finance Bill to Parliament, which must consider and approve it within ninety days of passing the Appropriation Bill. This process ensures transparency but may limit flexibility in tax policy changes. The tax reviews should only be considered in the medium and guided by evidence.

d) Political Processes: Kenya’s tax structure is influenced by national and regional politics, with political parties and leaders shaping tax policies based on their promises and agendas, affecting the allocation of public resources.

e) Convergence between Legal, Process, and Economic Problems: The mandatory nature of the Finance Bill’s consideration annually poses challenges. Economic growth influences revenue generation, and tax changes may not yield additional revenue if the tax system lacks buoyancy and elasticity. Tax rates need to be within the Laffer curve for optimal revenue generation.

Conclusion

Kenya faces intricate challenges in tax policy, influenced by political, structural, and institutional factors, raising concerns about transparency and effectiveness. The tax code’s complexity and frequent changes require a deeper understanding. The methodology provides a comprehensive view, emphasizing problem identification and potential change processes.

Policy concerns include the use of omnibus bills impacting transparency, the alignment of old constitutional norms, and the size of the tax code. Mandatory consideration of the Finance Bill annually raises questions about the responsiveness of tax measures to economic growth.

The power map of Kenya’s tax code stakeholders reveals diverse interests and influences. Key recommendations include simplifying the tax code for Parliament, fostering collaboration between the National Treasury and Parliament, emphasizing voluntary compliance for the Kenya Revenue Authority, and championing fair tax systems for Civil Society Organizations. Transparency, fairness, and collaboration are common themes, with a shared call for a shift to predictable finance bill reviews. If implemented collaboratively, the proposed reforms can create an efficient, transparent, and development-aligned tax system for Kenya’s economic growth.

End Notes

[i] Kemboi, Leo. K., & Kagume, J. (2024). Political Economy Analysis of Taxation Policy in Kenya. Institute of Economic Affairs Kenya.

[ii] IEA Kenya. “IEA Kenya Webinar #3of2024 on the Political Economy of Taxation in Kenya.” Www.youtube.com, 16 Apr. 2024, www.youtube.com/watch?v=sHvrxlPxDmc&t=728s.

More Blogs

Gen Z Collective Action on Taxation and Economic Policy.

Introduction The Finance Bill 2024 in Kenya sparked a wave of collective action primarily driven by Gen Z, marking a significant moment for youth engagement in Kenyan politics. This younger generation, known for their digital fluency and facing bleak economic prospects, utilised social media platforms to voice their discontent and mobilise protests against the proposed […]

Two Immediate Monetary-Framework Imperatives for Mr. Mbadi

The credibility of Monetary Policy in Kenya is compromised at present by two factors: As we anticipated mid-year, inflation is headed below the target range for the first time; The 7-member Monetary Policy Committee (MPC) has four vacancies. In light of the former prospect, the MPC reduced the Central Bank of Kenya (CBK) Policy Rate, […]

Important dates and Citizen Concerns During Budget Planning Phase for Fiscal Year 2025/2026

The Budget formulation and preparation process in Kenya is guided by a budget calendar which indicates the timelines for key activities issued in accordance with Section 36 of the Public Finance Management Act, 2012.These provide guidelines on the procedures for preparing the subsequent financial year and the Medium-Term budget forecasts. The Launch of the budget […]

Adjusted IMF Program Demands on Kenya

In the IMF WEO published yesterday, the IMF elaborated its macroeconomic framework for the ongoing IMF program. The numbers clarify how the program, derailed by the mid-year Gen-Z protests, has been adjusted to make possible the Board meeting for the combined 7th and 8th Reviews scheduled for October 30. The adjustments, unfortunately, again raise profound […]

What does the Nobel Prize in Economics 2024 mean for Constitution Implementation in Kenya?

Daron Acemoglu, Simon Johnson, and James A. Robinson won the 2024 Nobel Prize in Economics for their research on how a country’s institutions significantly impact its long-term economic success.[1] Their work emphasizes that it’s not just about a nation’s resources or technological advancements but rather the “rules of the game” that truly matter. Countries with […]