Economic Burden Of The Informal Sector

Economic Burden Of The Informal Sector

| Post date: Wed, Dec 7, 2016 | | Category: General | |

The informal sector refers to a section of the economy that encompasses all jobs which are not recognized as normal income sources, and on which taxes are not paid. The informal sector employs over 80% of the Kenyan working population. This is the same case in most developing countries, where the informal sector accounts for up to half of most economic activity. The role of the informal sector in economic development however, still remains controversial. Today’s number looks at the rapid growth of the informal sector in Kenya and how it can be a great hindrance to the advancement of the Kenyan economy.

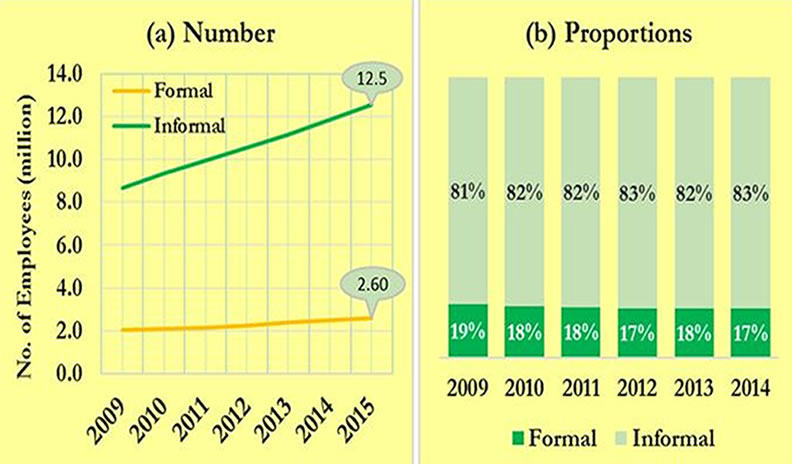

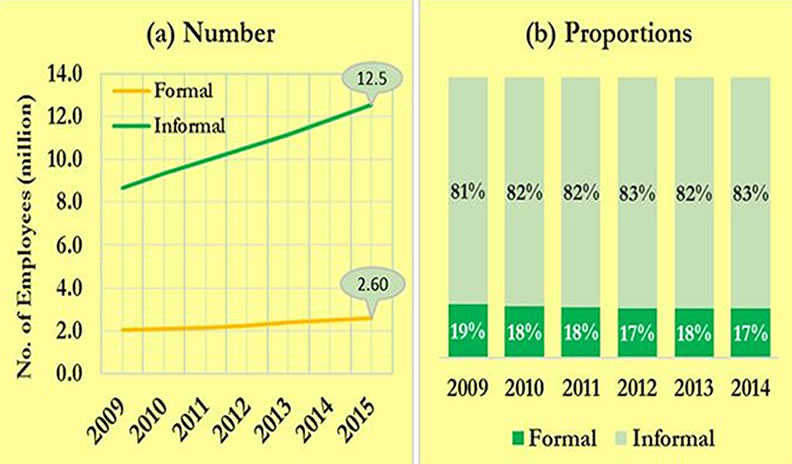

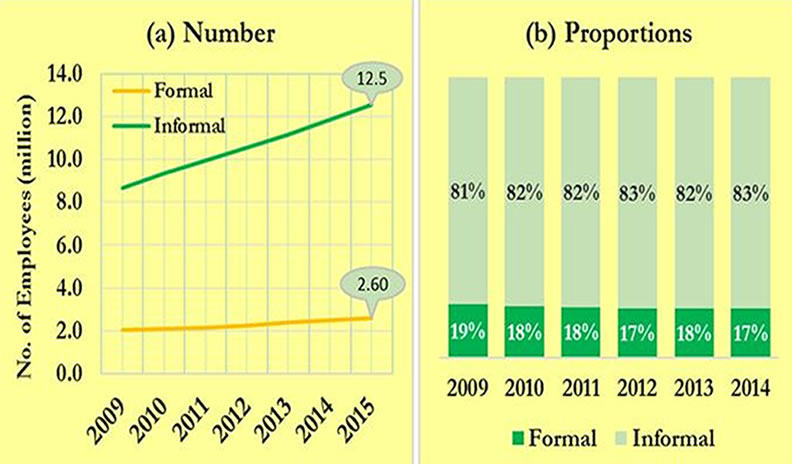

Chart 1: Trends of Formal and Informal Employment (2009 – 2015)

Source: Author’s Calculation from Economic Survey & Statistical Abstract (various issues)

Charts 1a, shows the trends of formal and informal employment from 2009 to 2015. It is evident that the informal sector is growing at a rapidly faster rate than the formal sector. The informal sector is employing almost five times more the number of employees than the formal sector.

Chart 1b on the other hand shows the proportion of working Kenyans in the formal and informal sector. The informal sector in Kenya takes up over 81% of the total working population in Kenya. The resulting assumption, as is characteristic of the informal sector in an economy is that a majority of these employees do not register or comply with any regulations; they make sales and pay for inputs including labor in cash; they do not have bank accounts and cannot access facilities provided for by banks and; they do not pay income tax.

Taxation is an important tool for governments to collect funds by imposing a charge on the citizens and corporate businesses. Potentially, these funds are used by governments for projects that provide services such as healthcare, social care, unemployment benefits, pensions, education systems, transport systems, security systems, infrastructure development and improving standards of living in remote or rural areas within a country.

Without these taxes, governments become stretched in providing services that are of benefit to the country’s population . In addition, the tax burden on decent income earned by individuals and businesses within the formal sector in a country may continue to become disproportionate. Taxation is also a way in which governments can collect information on how much money is available to successfully implement the different projects that they plan to have for the benefit of the masses.

Today’s number is 83%, which is the percentage of employees within the informal sector. This number also represents the majority of Kenyans who have the ability to be employed, are working and do not pay income tax. It also represents the number of Kenyans who do not have a suitable means of income and are exposed to volatile working conditions. These conditions include unsecured social protection, social security and labour protection through fundamental workplace rights and; sustainable regular income plans.

Number of the week 83%:

- 83% of the Kenyan working population are employed within the informal sector

- Approximately 83% of the working population does not regularly contribute to government revenue through income tax but shall regularly require government services including a secure income generating environment

- Being within the informal sector means that one is not fully under the monitoring and evaluation ability of the law when it comes to workplace policy and is therefore more vulnerable to abuse over wages, conditions, maltreatment, and dismissal

- Informal jobs are usually associated with low and irregular pay therefore making a majority of those employed in the informal sector poor

- Informal jobs often means very low productivity as most of the time there is no specified authority to monitor the level of productivity taking place

- The formal sector only employed 2.6 million Kenyans in 2015 whereas the informal sector employed almost five times this number in the same year

More Number of the Week

Kenya’s comparison of Out of pocket expenditure on Health with its peers

In the advent of increased Non-Communicable Diseases such as cancer that require long time treatment, reduction of the Out-of-pocket payments is key in sustaining affordability and access to health care services. These can be achieved through increased insurance both by the government and the private sector.

Outstanding Stock of Treasury Bonds by Holders

Treasury bonds are a secure, medium- to long-term investment tools that typically offer periodic interest payments semiannually throughout the bond’s life. The Central Bank auctions Treasury bonds on a monthly basis, but offers a variety of bonds throughout the year, so prospective investors should regularly check for upcoming auctions. Outstanding Treasury Bonds increased by 11.2 per cent to Ksh 1,152,041 million in June 2016 from Ksh 1,035,662 million in June 2015.

Outstanding Stock of Treasury Bills by Holders

In June 2016 compared to June 2015, the stock of Treasury bills increased by 84.4 per cent to Ksh 588,088 million from Ksh 318,929 million while the proportion held by commercial banks increased by 67.4 per cent to Ksh 361,859 million from Ksh 217,742 million. In the same period, holdings by pension fund institutions increased to 20.1 per cent from 12.8 per cent while proportion held by insurance companies decreased to 3.1 per cent from 6.5 per cent.

Outstanding Stock of Treasury Bills and Bonds by Holders

The medium term debt strategy for the financial year 2016/17 emphasized on the need to develop the domestic market by increasing the issuance of Treasury bonds over the medium term. The strategy targeted a mix of 60 percent and 40 per cent for external and domestic financing, respectively.

Trends in Kenya’s Total Domestic Public Debt Stock from 1999 – 2018 (In nominal terms)

Trends in Kenya’s Total Domestic Public Debt Stock from 1999 – 2018 (In nominal terms) Source: Central Bank of Kenya The number of the Week: 2.1, this is the factor by which domestic debt has grown in the last five years. Domestic debt has nearly doubled in the last five years (2013-2018) Between 1999 and […]